Public charging networks are growing all over the world but are they competitive? Of course, all marketing managers will surely promote the performance of charging station with great power output, coverage with number of charging points, great services with smartphone applications and 24/7 hotline. Despite all these parameters, Pricing is often underestimated as if EV drivers should be thankful to have access to public charging stations. This is often the case when new markets are opening but will quickly change when competition arise. Thankfully, this is already happening in multiple eMobility markets. The upcoming interconnection of charging station networks thanks to eRoaming solutions do offer access to thousands of public charging points all over Europe. When you get access to almost the same product, pricing become highly strategical! So, what should be the right price?

Let’s first try to understand the elements to determine a charging price:

- Costs: Energy, service and infrastructure

- Offer and Demand: Driver readiness to pay for charging

- Strategy: Competition, tactics and goals

What are the cost of public charging?

The cost of public charging is depending of all elements needed for a driver to stop and charge a car. In a gasoline station we would calculate the brute price of oil, refinery costs and finally different taxes and a margin to cover all running costs (location, salaries, infrastructure and payment system…).

In the electricity world, we don’t have to refine the product, we just have to deliver it with the right power and that depends of the infrastructure and the way we can access it. The biggest difference with gazonline is that public EV charging networks are organised around a “Service provider” structure which makes them closer to Mobile operators than a gaz station model.

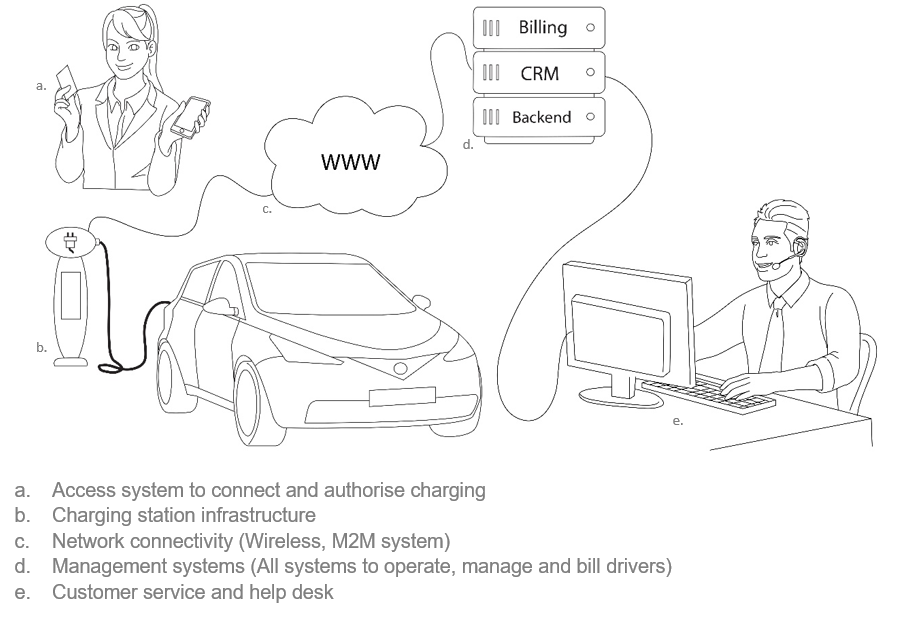

Here is a representation of the structure and all elements that you have to take into account to run a public charging network:

Next to these, you have to take into account all commercialisation costs to acquire and manage drivers and owners of charging stations and of course the electricity costs.

Offer and demand: Driver readiness to pay?

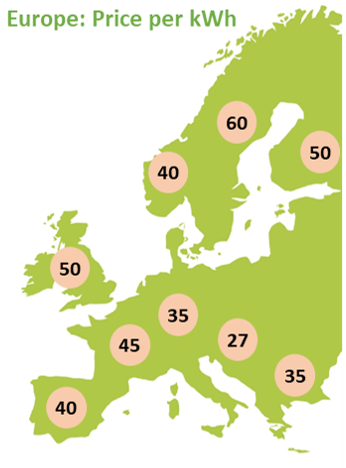

Despite a growing eMobility service provider competition with a variety of prices, the biggest benchmark remains the retail price of electricity. Basically, what drivers are paying at home to charge a car. This is rather unusual in comparison to the gasoline world and makes Drivers less dependent to public charging network. At least for a radius of 150 to 500 km where customer have to charge a car and may more interested about the location, ease of use (access, payment) and charging time (power output) rather than the price. It means that they are quality oriented but not ready to pay fantasy prices and would compare eMobility provider offers.

Strategy: How do you want to charge your customers?

The concept and way of billing is strategical. The objective is to gain, retain and finance Charging station investors. We can already see 2 major pricing concepts and various pricing types.

Pricing concepts:

1. Per station-based pricing

The benefit of this model is that owners of charging stations can define price schemes according to their needs. For example, a low pricing policy, to attract customers for other services (e.g. restaurant, coffee clients…) or a progressive pricing per minute to encourage drivers to free up charging stations for the next driver. The weakness is that it does generate a multitude of prices which can only be checked over a smart phone application. We can compare this pricing concept with the gas station model where prices can be openly set. There are however 3 massive differences:

- 1st Gas station prices are clearly indicated on the facilities. You do not have to open a smartphone application to check prices

- 2nd Way of billing per litre or gallon is always the same. There is no multiplicity of type of pricing such as minimum amount, setup or per minute billing.

- 3rd price disparity is very low. eMobility drivers have to count with charging prices with differences of almost single to double in a radius of a few miles.

2. Network pricing

Country with Zones:

The network pricing is in reference to telecommunication type of companies. The service provider, respectively the, EMP defines prices depending of geographical zones or charging station networks. It’s a network to network type of pricing with fix type of pricing per area, which could be local, national or international countries.

In summary, the difference of both prices is about the logic of pricing calculation from the Driver or from the Charging Station. I tend to prefer the pricing approach from the Driver which is the customer of these networks.

Billing plan types:

Billing plan types are about the way drivers can be billed for charging transactions. There are a lot of possibilities depending on system capabilities, regulation and goals.

| Per kW | Effective billing based on charging quantity |

| Per minute | Ideal if you want to motivate drivers to free up charging facilities once the car is fully charged or to comply with countries regulations |

| Per transaction/Setup | One-time cost generally used to simplify billing (e.g. SMS services) |

All these prices have a reason to exist. However, the best way could be a mix of all these pricing types. For examples, this charging plan that I have seen recently in the US:

– Setup to give access to the charger

– Per kW until the car is charged

– Per minute for all remaining time after completion of the charging process